We may receive commissions on purchases made from our chosen links. If you need to send a friend, relative, roommate, or anyone else money for anything ranging from splitting a restaurant check to your share of the rent, these social payment apps have you covered. PayPal is the granddaddy of payment companies, with a history going back to PayPal offers the ability to transfer money to and from any U. There is no fee to transfer funds to family or friends from a PayPal balance or bank account balance, but PayPal does appw fees to send from a credit card or convert currencies. Venmo is an app designed primarily to send money to friends, with an embedded social aspect. And, while you can sign in and access your account on the internet, it is a mobile first experience built primarily for use on the go with your smartphone.

More Money Hacks

What mobile money apps are connecting best with U. After review, we think these personal financial apps — with everything from credit card rating services to household budget calculators and much, much more — earn the top grades. This mobile app promises a nuts and bolts personal financial planning experience for users, with regular updates on bank deposits and withdrawals, snapshots of real-time spending, and the ability to pay bills. Mint also offers a helpful and free credit score tracking service, but on the downside, Mint updates appear to be somewhat dated, with updates on things like online bank deposits appearing in your email box days after the transaction actually occurred. Acorns is somewhat unusual — even for the technology-advanced mobile app market. The app was designed with the help of famed Wall Street investor Harry Markowitz, so if nothing else, Acorns has the pedigree factor covered. Otherwise known as You Need a Budget get it? This money mobile app, like YNAB, offers personal financial budgeting and tracking as its primary feature that helps consumers keep tabs on everyday spending. My Budget Book is available in 10 languages and its easy-to-read graphics are state-of-the-art. On the downside, ramping up on what you’ll need to do to get your bookkeeping up and running can take some time. Digit is all about the easy, efficient scheduling of automated payments to your bank savings accounts. The app reviews your personal financial picture and figures out a reasonable, doable amount of money from your monthly income and steers it straight into your savings account. Digit uses a sophisticated algorithm to decipher the best amount of money it can pop into your savings account from your monthly income.

MORE IN LIFE

The idea is that you’ll barely notice the cash is missing, and it promotes good savings habits. Some call him a prophet and some call him a huckster, but you can’t deny the Tony Robbins brand is at the top of the self-help pyramid. For that reason alone, his money app is worth a look. Users do report having problems accessing the site but the Tony Robbins brand says those issues are resolved. What the site does offer is exclusive financial advice from Robbins and his many guest experts who appear with him at conferences and seminars. Unlike most financial apps, the Robbins app promotes holistic steps to take to reach money nirvana, like deep breathing exercises. The app is free. This personal finance app takes a straightforward, almost simplistic approach to personal money management.

A better way to pay, by Google

Google Pay is the fast, simple way to pay on sites, in apps, and in stores using the cards saved to your Google Account. It protects your payment info with multiple layers of security and makes it easy to send money, store tickets, or cash in on rewards — all from one convenient place. When you use your phone to pay in stores, Google Pay uses an encrypted number instead of your actual card number so your details stay secure. Google Pay protects your payment info with industry-leading security technologies so you can pay with peace of mind. Google serves cookies to analyze traffic to this site. Information about your use of our site is shared with Google for that purpose. Let’s roll. Just landed! Come join the sun. I’m thinking takeout? Already on it.

Our commitment to you

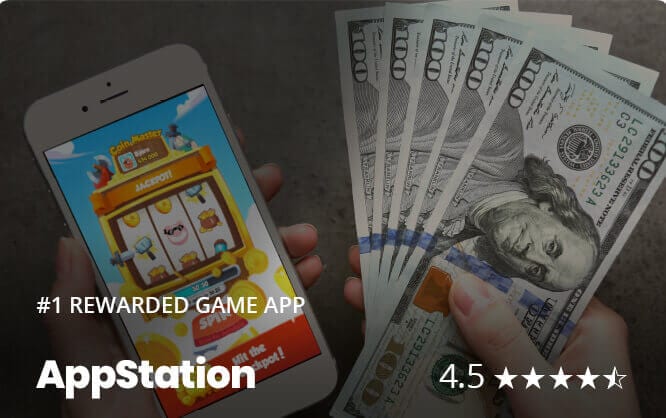

Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. Some of the links in this post may be from our partners. Need some extra cash? Do you spend a lot of time on your smartphone? I know I do. What if, instead of wasting time on your iPhone, you could actually make some money instead? As it turns out, there are a ton of money making apps out there that allow you to work online — more than you might expect.

MORE IN Money

Using Skiplagged, you can find cheap flights and hotel rates. Earn cash back for shopping online, submitting a receipt or linking a loyalty account by downloading Ibotta with your iOS or Android device. It might turn out that a train journey is much cheaper than a flight. And, you can also participate in group chats, and video calls, and send messages. You can find music from a huge range of genres on there, as well as live sets. Also, you can send media and files, of all sizes and types, and create a group chat for up to , members. If nothing happens, download Xcode and try again. You can browse deals from stores and restaurants.

Most Popular

Proud Supporter of: Stray Rescue of St. More from GOBankingRates:. You can redeem deals directly from your mobile device. So, why not use an app that could save you cash on your next grocery shopping trip? Join Opinion Outpost It is free. This helps you to find the best in-store coupons and deals. These points can be redeemed for gift cards from ssve like Amazon, Target and Walmart or for PayPal cash. Or maybe you want to pay down any debts you may .

22 Best Money Making Apps for 2020

Want to save more money? There are tons of money-saving apps out there that can cut the cost of everything from groceries to travel. And, there are also dozens of apps available that automate savingscut down your expenses and even invest your money for you! Some of these apps also fall into the free money making apps category since they earn you cashback when you shop through. Instead, these apps just help you to save money in general by doing things like helping you to avoid late fees, giving you tools to create a budget and cancelling subscriptions you no longer need.

Clarity Money is an interesting app that helps you to organize your finances and save money. With the app, you can find and cancel unwanted subscriptions. This is great because you can cut down your monthly expenses. Also, you can use the app to set savings goals and to track your monthly spending. You can use Mint to organize your finances. With it, you can create budgets, and check your credit score. You can also get alerts about upcoming bills, and schedule payments.

This means that you can avoid late fees, and therefore save cash! This is an interesting app that helps you to budget and save money more efficiently. This app allows you to connect all your bank accounts in one place, and budget across your devices. It offers a variety of budgeting tools and features. There are also tools available that help you to pay down your debts.

You can also set and track financial goals. Trim analyzes your accounts to find recurring subscriptions, and to see where you can save money. Then, it automates saving for you, by doing things like cancelling subscriptions, negotiating your bills, and finding you better car insurance. You need to visit the Trim website to join. Then, you have to connect your Facebook Messenger account so that Trim can communicate with you. Using Wallaby, you can ensure that you never miss out on rewards.

Essentially, it helps you to use the right card to pay for your purchases in order to get the best rewards. It can also help you to use the right card to pay for services like internet, telephone, and cable TV. Launch the app for online or offline shopping and Wallaby will let you know which card you should use to maximize rewards from each of the cards in your wallet. The apps in the section below round up your purchases and then automatically save the money for you.

This is great because it allows you to save little and often, which can really add up over time. Acorns rounds up your purchases to the nearest dollar and then invests this change for you into a portfolio of ETFs of over 7, stocks and bonds.

This is such a great way to grow your money. Just connect the cards and accounts you regularly use to get started. If you invest more than that, then it will charge 0. When you make a purchase or pay a bill with your Chime Visa Debit Card, Chime rounds up the transaction to the nearest dollar amount and transfers the spare change from your Spending Account to your Savings Account. Also, you can automatically save each time you get paid. Make a purchase with your Bank of America Debit card and the Bank of America app will round up the purchase total and save the change.

Just enroll your debit card in the program. Link the checking account and credit cards you normally buy stuff with to your BoostUp account. Then, the app will round up your purchase total to the nearest dollar amount, and save the spare change for you in your BoostUp account.

Read our BoostUp review to learn more about this app. Each time you buy something, Qoins will round up your purchase total to the nearest dollar. Then, the app uses your spare change to pay smartwallet apps that save and make you money your debts. Paying off your loans sooner saves you so much money on interest, so this really is a good app to consider. A lot of us know that we should save, but never seem to get around to actually doing it each month.

These apps will totally automate the savings process for you. Digit automates the savings process for you. Link your checking account, and Digit analyzes your income and spending habits, to determine how much you can save. Then, each day, it automatically moves some money from your checking account into your Digit account. It only moves what you can safely afford to save. Simple is a budgeting and automatic savings app. Choose a savings goal, and Simple will automatically move money based on the amount you decide, and how often you want to fund your goal.

For example, it shows you how much money you have left to spend once all of your bills and other scheduled expenses are paid. Money Clouds is an iOS app that you can use to set up personalized, automatic saving plans for your financial goals. Then, the app will transfer your money automatically into your app account on your chosen dates. Albert is an app that you can use to invest, budget, and tackle your debts. With this financial assistant app, you can also save money and instantly move it between your goals.

This app also offers many other tools and features, such as the ability to sync all of your financial info such as your bank accounts, loans and credits cards all in one place, and notifications when bills are due and other things happen with your money. One of our biggest recurring expenses is groceries. So, why not use an app that could save you cash on your next grocery shopping trip? Some of them give you great coupons and promos, and others pay you for uploading your receipt when you purchase certain items.

Just make sure that you keep your receipt! It offers free, paperless grocery coupons for stores, like:. And, you can print coupons right from the app, if you prefer paper ones. SmartSource provides you with clip-free coupons that are loaded directly onto your loyalty card. When you use your loyalty card at the checkout, discounts are applied automatically. Grocery Smarts takes local grocery store ads and then matches them up with coupons.

This helps you to find the best in-store coupons and deals. With the Krazy Coupon Lady app, you can find coupons for a variety of grocery stores, and drug stores, like:. There are thousands of coupons on there, and 60 new deals are added per day. You can even create a shopping list, store your coupons and sync it across all of your devices.

KCL is one of the best grocery saving apps out. GroceryIQ is a grocery shopping list app, which can also save you money. Using it, you can search for free coupons, and view recommended coupons. And, you can print or email coupons, or add them directly to your store loyalty card. Flipp is a weekly shopping app that allows you to view weekly circulars for free. With the app, you can browse digital circulars from more than retailers. So, you can see what money-saving deals are available at stores near you.

This saves you both time and money. Go shopping anywhere, and Receipt Hog will pay you. Just upload a photo of your receipt. Money is sent via PayPal, or you can get it transferred to an Amazon gift card. This app will pay you for any itemized receipt.

Payment is sent via PayPal. Plus, there is no minimum withdrawal. So, you can get your money at any time.

When you take a photo of your receipt, and upload it, ReceiptPal will pay you with gift cards. Where to get it:. This is such a good app for saving money on groceries. Then, purchase the qualifying items, and upload a photo of your receipt. Ibotta will pay you the cashback credit through PayPal, Venmo or gift cards for places, like Amazon and Starbucks. Check out our full Ibotta review to learn more about this app. BerryCart focuses mostly on organic, non-GMO type food. When you go shopping, it will give you cashback if you upload a photo of your receipt.

You get your cashback through PayPal, or it can be put onto a gift card if you prefer. When you purchase items from featured brands, Jingit pays you. Just upload a photo of your receipt, or scan barcodes at the store. Payment is sent via direct deposit into your bank account. Or you can get a gift card for stores, such as Target and Walmart instead. Select the offers you want in the app, purchase the qualifying items, upload a photo of your receipt, and Checkout51 will give you cashback.

SavingStar is a paperless grocery coupon service.

The Smart Wallet is an independent publisher dedicated to delivering our readers simple solutions in personal finance. Its content including articles and tools is provided for free and for informational purposes. As information can change quickly, we cannot guarantee the accuracy of the information we present on a daily basis on previously published posts, nor guarantee the applicability of the content to your individual circumstances. However, we do strive to provide accurate, reliable information. We believe that anyone can take control of their financial destiny and that there is everyday magic in simple, honest advice.

Thank you for signing up!

We know our readers expect nothing. We also believe in transparency and we partner with brands many of them are free to use that have products and services that will help our readers. If you click on one of those links and purchase an item, sign up for a promotion, download an app, or complete a required action, The Smart Wallet may receive a commission. Anytime we partner with a brand, we make it clearly known. Because we believe our content should help you first and foremost, we will cover brands outside our partnerships because we feel their services or products truly benefit our readers. Though our partnerships may influence where those products appear on the site, they in no way affect our recommendations or advice, which are grounded in intensive research. We go to bed with it, wake up with it, look at it out of habit, and just feel more reassured feeling the weight of it in your hand. Because while our favorite device is the biggest time-waster it also provides opportunities to make actual money. In the app, all available free games are listed so just take your pick to try! The more time spent on each game, the more money you can earn. Get Paid to Game with Mistplay. Scratched all of them for the day? Regular giveaways are always happening. Until October 31st, you could win a trip for four to Walt Disney World!

Comments

Post a Comment