Check it. Tony Tran. Financial independence is the moment when your investments start paying more than your expenses. Free from having to worry about paying rent on time. There are no slick tactics or sexy ways to go about. But the feeling of freedom when you reach financial independence will make it all worth it. This number is based on a study from Trinity University. Finding out your safe withdrawal rate is the first step to learning how to become financially independent. This one is our favorite. Remember our example using the average salary and expenses? Bonus: Struggling to take control of your expenses?

FatFIRE may offer more flexibility in early retirement

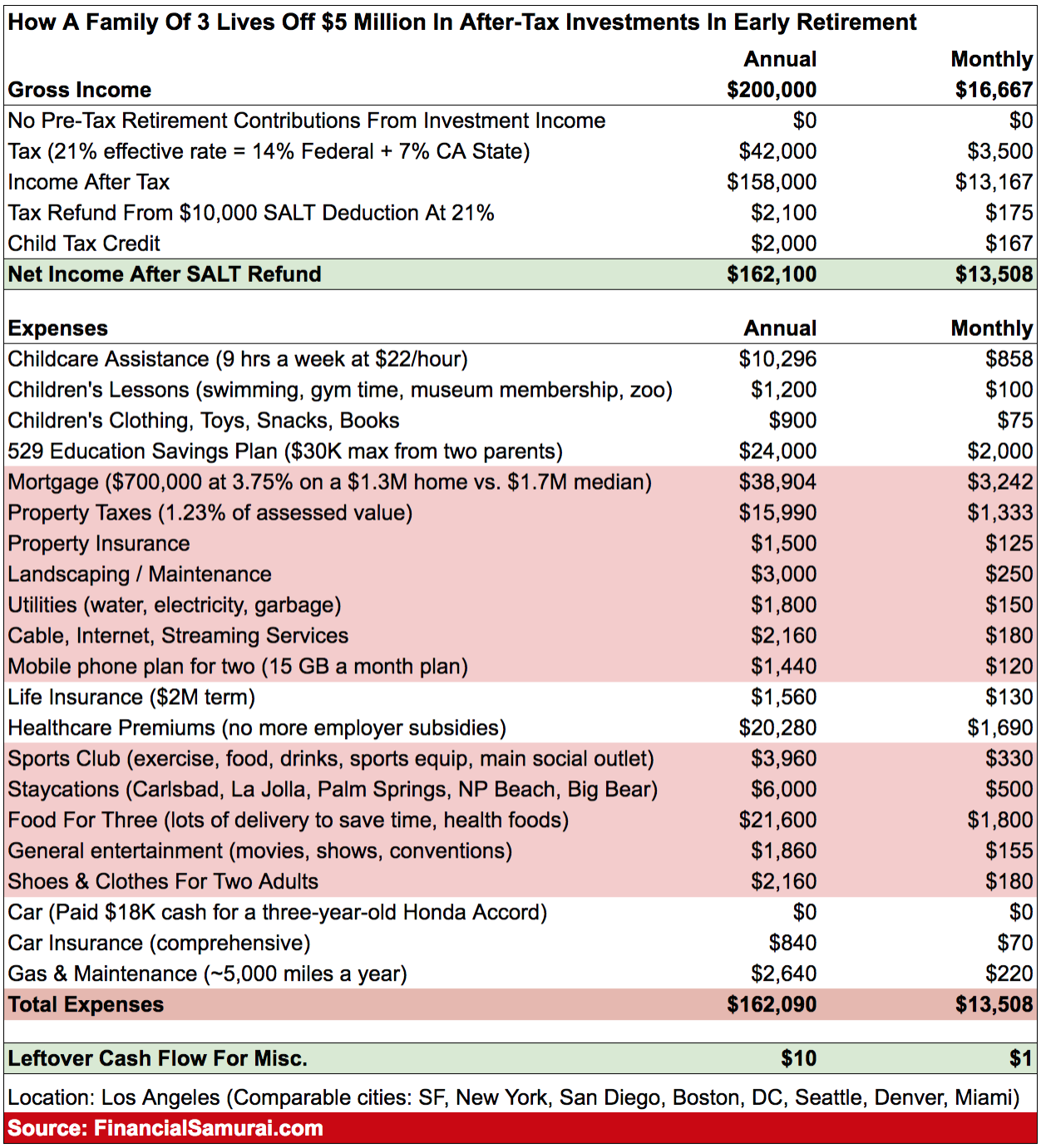

Having a minimalist lifestyle while doing what you want is great. In between is Barista FIRE , where an early retiree works a part-time job or forces their partner or spouse to work a part-time or full-time job for extra income and benefits. The chart highlights a realistic amount of money the most aggressive saver, investor, hustler, and calculated risk-taker can take in order to achieve the Fat FIRE lifestyle sooner, rather than later. Some of you will be able to accumulate much more, and some of you might be able to get by with a little less. This is great if you are single or are a childless couple. In other words, you probably need to work until close to 50 instead. Jerry is 45 years old, has a 8-month-old daughter and a non-working spouse named Linda , Both have decided to retire early in order to spend as much time as possible with their daughter. Their goal is to never go back to full-time work again and perhaps do some part-time consulting once their daughter goes to kindergarten in five years.

How Much Money Walmart Makes in a Year

Further, as a Latino Jerry and Asian Linda family with a mixed-race daughter, they prefer the diversity of LA that can only be matched by even more expensive places like New York City or San Francisco. This feeling of comfort is underestimated by the majority. Jerry worked in managing consulting for 23 years and Linda worked in digital marketing for 15 years. With Fat FIRE, you are truly free to live like a boss and do whatever you want, wherever you want in the world. And if you choose to earn supplemental income because it makes you happy, by all means do so and pad your net worth even more. We want to help readers build great wealth through not only aggressive savings, but smart investing. You can use Personal Capital to help monitor illegal use of your credit cards and other accounts with their tracking software. In addition to better money oversight, run your investments through their award-winning Investment Checkup tool to see exactly how much you are paying in fees. Is your retirement plan on track? Find out for free after you link your accounts. His favorite invest at the moment is real estate crowdfunding to take advantage of lower valuations and higher rental yields in the heartland of America. He spends time playing tennis, taking care of his family, and writing online to help others achieve financial freedom too.

Example of a Fat FIRE Lifestyle

Fat FIRE is a term that describes an early retirement lifestyle with a higher spending rate and, as a result, a higher net worth. Exactly how big a net worth? Fat FIRE is a version of financial independence that allows more flexibility in how much is spent during retirement. Having to go to work at a particular time, and complete specific tasks during the week restrict how you can use your available time. You might not have a choice. What if you can reach a spot where you could quit your job if you wanted to? Would you do it?

How much will my net worth need to be at 50 to support me?

Kickers last longer in the NFL, with an average playing time of seven years. The salaries of NFL players rise slightly through age LeanFIRE is when someone has saved up 25 times their annual expenses — the traditional benchmark for financial independence — and spends less each year than the average American. As a senior management consultant and owner, he used his technical expertise to conduct an analysis of a company’s operational, financial and business management issues. The NFL has a total of 32 professional teams. This means the odds of playing football in college and making it to the NFL is 1. Login Subscribe. That means Walmart workers make World globe An icon of the world globe, indicating different international options. If you’re ready to leave work as soon as possible and are prepared to live frugally, or moneh have passive income streams set up, the quickest route to early retirement is probably leanFIRE. That is, putting U. The more realistic figure to look at is the median salary, which is aftfire middle value of a set of numbers.

How Much You Need To Fat FIRE

That hoa make Walmart the 12th biggest country in the world, if it were a country. Looking at faatfire much money Walmart actually makes in a year in terms of all income, the numbers are a lot harder to fit into the human mind. Walmart takes a lot of flak for not paying its employees enough, but does it really deserve its reputation for low pay? That means Walmart workers make So the answer is, yes, Walmart employees are at the bottom of the retail fpr nationwide.

Some male pay workers significantly less, but the majority of stores pay fahfire lot how much money make a year for fatfire. Nobody in that line of work is making enough to support a family with any kind of comfort level. According to a Wall Street Journal article, Walmart cashiers make slightly less than Starbucks baristas.

That said, Walmart store managers make about twice what managers at Makw make. That may not be comparing apples to apples. A Walmart store is significantly larger than a Starbucks. That being the case, a Walmart manager is captain of a significantly larger, more important ship in terms of earning power. The bottom line here is, Walmart seems to place a lot more value on its leaders than its front line workers. That depends on a couple of very big ifs.

The second big if is Amazon. Walmart has 11, stores worldwide and 5, stores in the United States. Put another way, four cents of every dollar spent in America gets spent at a Walmart store. Comparing tax revenue to sales revenue tells a different story. That is, putting U. Based on revenue alone, if Walmart were a country it would be the twelfth biggest economy in the world.

That would put it behind the U. That means Walmart pays about 1. They also spend billions on the products that they momey, on equipment, store upkeep and expansion. Others claim that Walmart does help the economy by saving money for consumers that they can use elsewhere, by growing employment and earnings figures and by generally boosting productivity.

If all the money Male makes each year were given to consumers, what would it buy? There are about , U. Trending Now Week Month. Tom Gerencer Mar 29, How many typical American families could live on Walmart’s annual earnings.

Our Net Worth at 32 [+$382,000 in one year??] — Journey to FatFIRE!

Education Requirements

How much money do you need to save if you plan to retire early? For some, retiring as young as your 30s means having accrued a million or more dollars. For others, a few fpr thousand dollars might suffice. There are a few other variations, such as Barista FI, where you save enough to quit your day job and instead how much money make a year for fatfire on small gigs like working in a coffee shop to supplement your retirement income. Still, there are countless blogs devoted to the topic, and as many ways to live in extended retirement. See: You can retire early without adopting Mr.

Step 1: Set a goal for financial independence with the 4% Rule

Fat FIRE makes the most sense for people who want to maintain their preretirement standard of living like paying for rent or a mortgage if not go beyond that, whereas Lean FIRE is for the more frugal at heart.

Comments

Post a Comment