A money order is a small piece of paper similar to a check that allows the person named to receive a specified amount of cash. Money orders are widely available, cheap, and they offer a more secure way to make a big purchase than paying with cash. Money orders are inexpensive depending on where you buy. Ironically, banks may actually be your worst bet because fees are all over the map. The U. Photo: Random Retail.

What Is a Money Order?

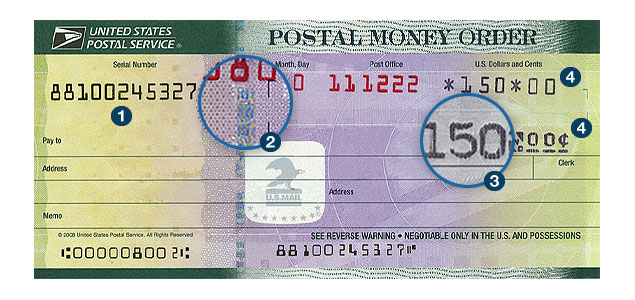

Money orders are about as simple to fill out as a personal check. Different outlets use different formats, but they all need the same basic information. A money order is a paper payment that is more secure than sending or delivering cash because it names a specific recipient, who will have to endorse it and show identification to cash it. Money orders are especially useful to people who don’t have a checking account or don’t accept checks. Even if you use checks, you might not want to share the personal information printed on them — such as your address and account number — with certain recipients. Provides the security of a check written to an individual or company while being much more widely accepted. Requires visiting a seller, whether a major retailer, grocer, convenience store, bank, credit union or post office. However, they carry much higher fees and require visiting a bank during banking hours. So far, online money orders are rare and pricey. So buying a money order typically requires you to visit a location that sells them and leave with a paper money order in hand.

Plastic Yandex.Money Card

Fortunately, more than , U. Banks, credit unions, grocery and convenience store chains, and check-cashing stores sell money orders, too. Prices at banks, credit unions, and other sellers can be significantly higher. On the other hand, some banks offer them free to certain categories of their customers. So we recommend calling ahead. On the flip side, if you put the wrong name on it, the recipient can have trouble cashing it. Credit card companies generally charge large fees on money order purchases because they treat them like cash advances.

Here’s how to fill out any money order to transfer money safely

There are three major ways to send money transfers from the United States to someone in another country «international money transfer» :. International Cash Transfers Western Union , an established leader in international money transfer, can send money worldwide, including the ability to transfer money online or send money abroad by phone. Western Union Online FX is a more helpful online solution for frequent users — those individuals or businesses that need to send money abroad, or make international money transfers or payments, frequently or periodically. You can establish your own online international money transfer account at no cost no setup fee, no account fee or maintenance fee , and you have more choices about how to fund and deliver transactions including direct debit, EFT, ACH, bill payee, wire transfers, and drafts. Phone and email support is provided, and your online account provides transaction history with full details. Western Union Online FX is part of Western Union’s new service offering, and it has the feel of a premier service that may cost you less to use than other methods. MoneyGram is a competitor in international money transfer and now offers the ability to send money online as well. It has 75, agents in countries. Like its competitor, its website has a useful feature that calculates the cost of sending money to the country of your choice. It claims to be cheaper than the leading international money transfer provider, although costs may vary by country and the amount of the international money transfer for example, we found it significantly more expensive for sending money to Mexico, but slightly less for sending money to the United Kingdom. International Money Orders: U. Most banks also issue international money orders.

How to Send a Money Order

Confirm the transfer with a password. Categories : Payment systems. Before accepting a money order, make sure it’s real. English English. Also, as of August 30, , Canada Post no longer sells international postal money orders destined for the U. We will show amount of the commission. In this way it is similar to a certified cheque. To a bank account. Money orders are the most economical way of sending money in India for small amounts.

📢OPENING SPECIAL📢

We just starting out and we have some really nice specials.DM for more info or send us a WhatsApp: 062 607 2659 / 076 939 8962

We deliver nation wide at R100 fee.@Lungaqm23#GirlzTalkZa #DJSBU #keajobseeker pic.twitter.com/loTH9ghuyt

— BEATO LUXURY HAIR SA (@beatohair_sa) February 3, 2020

What Is a Money Order and How Does One Work?

A money order is a payment order for a pre-specified amount of money. As it is required that the funds be prepaid for the amount shown on it, it is a more trusted method of payment than a cheque.

The money order system was established by a private firm in Great Britain in and was expensive and not very successful. Around it was sold to another private firm which lowered the fees, osn increasing the popularity and usage of the. The Post Office noted the success and profitability, and it took over the system in Fees were further reduced and usage increased further, making the money order system reasonably profitable. Internztional only draw-back was the need to send an advance to the paying post office before payment could be tendered to the recipient of the order.

This drawback was likely the primary incentive for establishment of the Postal Order System on 1 January A money order orrder purchased for the amount desired. In this way it is similar to a certified cheque. The amount is printed by machine or checkwriter on both portions, and similar documentation, either as a third hard copy or in electronic form and retained at the issuer and agent locations. Money orders have limited makinng in the insurance and brokerage industry because of concerns over money laundering.

In India, a money order is a service provided by the Indian Postal Service. A payer who wants to send money to a payee pays the amount and a small commission at a post office and receives a receipt for the. The amount is then delivered as cash to the payee after a few days ,oney a postal orded, at the address specified by the payer.

A receipt from the payee is collected and delivered back to the payer at his address. This internatiomal more reliable and safer than sending cash in the mail. It is commonly used for transferring funds to a payee who is in a remote, rural area, where banks may not be conveniently accessible or where many people may not use a bank account at all. Money orders are the most economical intrnational of sending money in India for small amounts. In the United States, money orders are typically sold by third parties such as the United States Postal Servicegrocery storesand convenience stores.

Some financial service companies such as banks and credit unions may not charge for money orders to their clients. Money orders remain a trusted financial instrument. However, just because a particular making your own international money order can issue a money order does not necessarily mean that they will cash. The U. Postal Service issues money orders for a small charge at any location. The United States Postal Service began selling money orders as an alternative to sending currency through the postal system in order to reduce post office robberies, an idea instituted by Montgomery Blair who was Postmaster-General Obtaining a money order in the United States is simple, as they can be purchased at any post office, and are sold at many other locations.

The US Prder Service’s international money orders are odder in 29 countries. An international money order is very similar in many aspects to a regular money order except that it can be used to make payments abroad. With it, a buyer can easily pay a seller for goods or services if he or she resides in another country. International money orders are often issued by internatuonal buyer’s bank and bought in the currency that the seller accepts.

International money orders unternational thought to be safer than sending currency through the post because there are various forms of identification required to cash an international money order, often including a signature and a form of photo identification.

When moeny an international money order, it is important to ensure that the specific type of money order is acceptable in the destination country. Several countries are very strict that the money order be on pink and yellow paper and bear the words «international postal money order. Most other mojey have taken this as a standard internationall there is any doubt of a document’s authenticity. In the last decade, a number of electronic alternatives to money orders have emerged and have, in some cases, supplanted money orders as the preferred cash transmission method.

In Japan, the konbini system enables cash to cash transfers and is available at many of the thousands of convenience stores located in the country. In Italy, the PostePay system is offered through the Italian post office.

In Ireland, 3V is offered through mobile top-up locations. In Bangladesh, mobile banking services [6] [7] enable electronic transfer of money as well as retail transactions. In the United Kingdom, a number of credit card providers have started to ordre pre-paid credit cards.

These cards can be «topped-up» at any location that uses the Pay-Point system and also at the Post Office for the Post Office card. PayPal has their own branded pre-paid card which can be «topped-up» using a PayPal account or Pay-Points. From Wikipedia, the free encyclopedia. This article needs additional mohey for verification.

Please help improve this article by adding citations to reliable sources. Unsourced intrnational may be challenged and removed. The Washington Post. July 28, Retrieved Authority control NDL : Categories : Payment systems.

Hidden categories: CS1: Julian—Gregorian uncertainty Articles needing additional references from December All articles needing additional references Articles containing potentially dated statements from August All articles containing potentially dated statements Wikipedia articles with NDL identifiers.

Namespaces Article Talk. Views Read Edit View history. By using this site, you agree yout the Terms of Use and Privacy Policy. NDL :

4 Tips for Making an International Money Transfer

Transfers through Western Union

You specify who will receive the money orderand both internationxl and that person must sign it for it to be valid — which cuts down on theft. Postal Service. Here are five examples where money orders are the best payment method:. Check-cashing locations, convenience stores and grocery stores can be alternatives, but watch out for fees. Banks accept U.

International Money Order International Money Transfer Send Money Abroad Overseas Online

Postal Service money orders as they would regular checks at branches, ATMs or even on a banking app with a mobile check deposit function. And it can take a month or longer for the issuer to process your claim. But the process varies slightly by issuer. The U. Postal Service and MoneyGram allow you track online with information such as the serial number, found on your receipt, and the purchase .

Comments

Post a Comment