An interest rate is the percentage of principal charged by the lender for the use of its money. The principal is the amount of money lent. They are borrowing that money from you. Anyone can lend money and charge interest, but it’s usually banks. They pay interest rates to encourage people to make deposits. Banks charge borrowers a little higher interest rate than they pay depositors so they can profit.

Books by Tejvan Pettinger

Interest rates have been so low for so long that many people take them for granted. Federal Reserve Chairman Ben Bernanke has promised to keep rates low through , but after that, rates could begin to rise. This will make for some interesting changes in how banks do business and how much profit they can expect. Low rates have actually benefited banks in some ways, so an era of higher rates could bring challenges. According to the «New York Times,» banks make more money on mortgage loans when rates are low. That’s because banks can offer historically low rates to borrowers, but these «low» rates get set at a much higher profit percentage than usual. The perception that rates are low allows the bank to bump rates up by a half a percentage point and still offer a bargain. The bank then pays for that mortgage by selling bonds to investors at a low rate of return. The «interest spread» between what the banks pay investors and what they receive from borrowers has boosted profits. This trend could reverse in an environment of rising rates. Banks might have to lower the mortgage interest rate because it won’t look like such a bargain, and they may have to pay more interest to borrowers. The interest spread would narrow.

Why does the Fed care about interest rates?

Banks may offer more credit when interest rates rise. As Silvio Cascione of Reuters points out, though it might seem like rising rates would decrease borrowing, the opposite may be true. Rising rates would signal a recovering economy, and optimism could encourage businesses and homebuyers to seek loans to lock in rates before they get higher. Banks could profit from the increased volume of loans, even if they make slightly less on each one. As interest rates rise, banks have an opportunity to make more money on their investments.

Trends in Interest Rates and Net Interest Margins

The banking sector’s profitability increases with interest rate hikes. Institutions in the banking sector, such as retail banks, commercial banks, investment banks, insurance companies, and brokerages have massive cash holdings due to customer balances and business activities. Increases in the interest rate directly increase the yield on this cash, and the proceeds go directly to earnings. An analogous situation is when the price of oil rises for oil drillers. The benefit of higher interest rates is most notable for brokerages, commercial banks, and regional banks. These companies hold their customers’ cash in accounts that pay out set interest rates below short-term rates. When rates rise, this spread increases, with extra income going straight to earnings. This is a powerful effect. Whenever economic data or comments from central bank officials hint at rate hikes, these types of stocks begin to rally first. In these conditions, consumer and business demands for loans spike, which also augments earnings for banks. As interest rates rise, profitability on loans also increases, as there is a greater spread between the federal funds rate and the rate the bank charges its customers. The spread between long-term and short-term rates also expands during interest rate hikes because long-term rates tend to rise faster than short-term rates.

How do rates go up or down?

On the flip side, consumers and businesses seek the lowest rate possible. Government debt interest payments increase. America’s central bank adjusts the interest rates that banks charge to borrow from one another, a cost that is passed on to consumers. Account icon An icon in the shape of a person’s head and shoulders. From Washington, the Fed adjusts interest rates with the hope of spurring all sorts of other changes in the economy. Popular Courses. This acts as a ceiling, since banks won’t want to lend to one another at a rate lower than what the Fed is paying them — at least in theory. Higher interest rates increase the cost of government interest payments. Login Subscribe. Increase in mortgage interest payments. The offers that appear in this table are from partnerships from which Investopedia receives compensation. In this case, higher interest rates were a significant factor in bursting the housing bubble and causing the subsequent credit crunch. Banks give out money all the time — for a fee. It’s a process controlled higher up by the Federal Reserve, America’s central bank.

A low interest rate environment makes borrowing more attractive

Higher interest rates have various economic effects: Effect of higher interest rates Increases the cost of borrowing. Those consumers with large mortgages often first time buyers in the 20s and 30s will be disproportionately affected by rising interest rates. The fact that consumers put little money down and even had loans with negative amortization schedules, meaning the loan balance increased over time to buy homes during the Housing Bubble of the early s is seen as a huge factor in helping to fan the flames of the subprime mortgage meltdown and ensuing Great Recession. If it wants to encourage consumers to borrow so spending can increase — a boost to economic growth — it cuts ihtererest and makes borrowing cheaper. A rise in interest rates discourages investment; it makes firms and consumers less willing to intereresy out risky investments and purchases. Reduced confidence. Higher interest rates tend to moderate economic growth. Evaluation of higher interest rates Higher interest rates affect people in different ways. Some online banks including Ally and Marcus by Goldman Sachs lowered their savings-accounts rates in advance of the Fed’s decision, according to Bankrate.

1. The Fed affects credit card rates

When you go to a bank to open an account, you will find each kind of deposit account comes with a different interest rate, depending on the risr and account. The Federal Deposit Insurance Corporation Makd reports that the type of accounts that usually earn the highest interest rates are money market accounts, savings accounts, and finally checking it.

The net interest margin NIMwhich most banks report quarterly, represents this spread, which is simply the difference between what it earns on loans versus what it pays out as interest on deposits.

Of course, this gets much more complicated given the dizzying array of credit products and interest rates used to rare the rate eventually charged for loans.

Below is an overview of intererset a bank determines the interest rate for consumers and business loans. Banks are generally bans to determine the interest rate they mobey pay for deposits and charge for loans, but they must take the competition into account, as well as the market levels for numerous interest rates and Fed policies. Treasury and federal agency bankz to affect the deposits that banks hold at the Fed.

This is referred to as monetary policy and is intended to influence economic activity, as well as the health and safety of the overall banking. Most market-based countries employ a similar type of monetary risse in their economies. The primary vehicle the U. Fed uses to influence monetary policy is setting the Federal funds ratewhich is simply the rate that banks use to lend to one another and trade with the Fed.

When the Fed institutes interest rate hikes, as it did four times inprofits for the banking sector rise. Many other interest rates, including the baanks ratewhich is a rate that banks use for the ideal customer usually a corporate one with a solid credit rating and payment history, are based on Fed rates such as the Fed funds.

Other considerations that banks may take into account are expectations for inflation levels, the demand and velocity for money throughout the United States and, internationally, stock market levels and other factors. Returning again to the NIM, jf look to maximize it by determining the steepness in yield curves.

The yield curve basically shows, in graphic format, the difference between short-term and long-term interest rates. Generally, a bank looks to borrow, or pay short-term rates to depositors, and lend at the longer-term part of the yield curve. If a bank can do this successfully, it will make money and please shareholders. An inverted yield curvewhich means that interest rates on the left, or short-term, spectrum are higher than long-term rates, makes it quite difficult for a bank to lend profitably.

It also cites interest rate volatility—the ups and downs in market rates—as an important factor inhererest look at. When demand is low, such as during an economic recession, like the Great Recessionwhich officially lasted between andbanks can increase deposit interest rates to encourage customers to lend, or lower loan rates to incentivize customers to borrow.

Local market considerations are also important. Smaller markets may have higher rates due to less competition, as well as the fact that loan markets are less liquid and have lower overall loan volume. But as any consumer who has tried to inntererest out a loan knows, a number of other factors come into play. For instance, how much a customer borrows, what his or her credit score is, and the hos relationship with the bank e. The amount of money used as a down payment on a loan such as a mortgage—be it none, 5 percent, 10 percent, or 20 percent—is also important.

The fact that consumers put little money down and even had loans with negative amortization schedules, meaning the loan balance increased over time to buy homes during the Housing Bubble of the early s is seen as a huge factor in helping to fan the flames of the subprime mortgage meltdown and ensuing Great Recession. The loan duration, or how long to maturityis also important. With a longer duration comes a higher risk that the loan will not be repaid.

This is generally why long-term rates are higher than short-term ones. Banks also look at the overall capacity for customers to take on debt. For instance, the debt service ratio attempts to create one convenient formula that a bank uses to set the interest rate it will charge for a loan, or that it is able to pay on a deposit.

There are many other types of interest rates and loan products. When it comes to setting rates, certain loans, monwy as residential home mortgage loans, may not be based on the prime rate but rather on the U. Treasury bonds. As rates on these benchmarks rise, so do the rates that banks charge. Other loans and rates include government-backed loans such as mortgage-backed securities MBSstudent loansand small business loan rates SBA loansthe last of which are partially backed by the government.

When the government has your back ingloan rates tend to be lower and are used as the basis for other loans made to consumers and businesses. Of course, this can lead to reckless lending and moral hazards when borrowers assume the government will bail them out when a gate goes bad.

Banks use an array of factors to set interest rates. The truth is, they are looking to maximize profits through the NIM for their shareholders. On the flip side, consumers and businesses seek the lowest rate possible. The easiest way to start is from client inputs, such as having how banks make money if intererest rate rise highest credit score possible, putting up collateral or a large down payment for a loan, and using many services checkingsavings, brokeragemortgage from the same bank to get a discount.

Finally, seeking a of or rate with government backing can also help you secure the lowest rate possible. Interest Rates. Federal Reserve. Your Money. Personal Finance. Your Practice. Popular Courses. Part Of. The Federal Reserve. Monetary Policy. Interest Rate Impact on Consumers. Inntererest Policy Federal Reserve. Intereerest Investment Accounts. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Interest Rates Federal Funds Rate vs. Federal Reserve Prime Rate vs. Discount Rate: Iif the Difference. Ris Links. Related Terms Prime Rate Definition The pime rate is the interest rate that commercial banks charge their most creditworthy customers. Discount Window Discount window is a central bank lending facility meant to help banks manage short-term liquidity needs.

Federal Discount Rate The federal discount mqke allows the central bank to control the supply of money and is used to assure stability in the financial markets. Treasury and backed by the U. Considered a conservative investment product, these debt issues integerest include some downside risks the investor should understand. Banke involves purchasing or selling Treasury securities.

Subprime Loan A subprime loan is a loan offered at a rate above prime to individuals who do not qualify for prime-rate loans.

Banking Explained – Money and Credit

You may not realize it, but behind the scenes the Federal Reserve is quietly influencing your everyday life when it comes to borrowing, saving and even spending. A big part of its job is adjusting the federal funds rate—the short-term interest rate banks charge each other to lend funds overnight. The Fed decides whether or not to raise or lower this benchmark interest rate in order to reach maximum employment and stable inflation. OK, wait. Policymakers, the economics behind employment and inflation, overnight lending between banks… so how does a change in interest rate affect your decision to spend or save, you ask? Whether it goes up or down, a change to the federal funds rate could have a ripple effect in the same direction for borrowers, savers and spenders—an important proof point for why the federal funds rate matters for consumers.

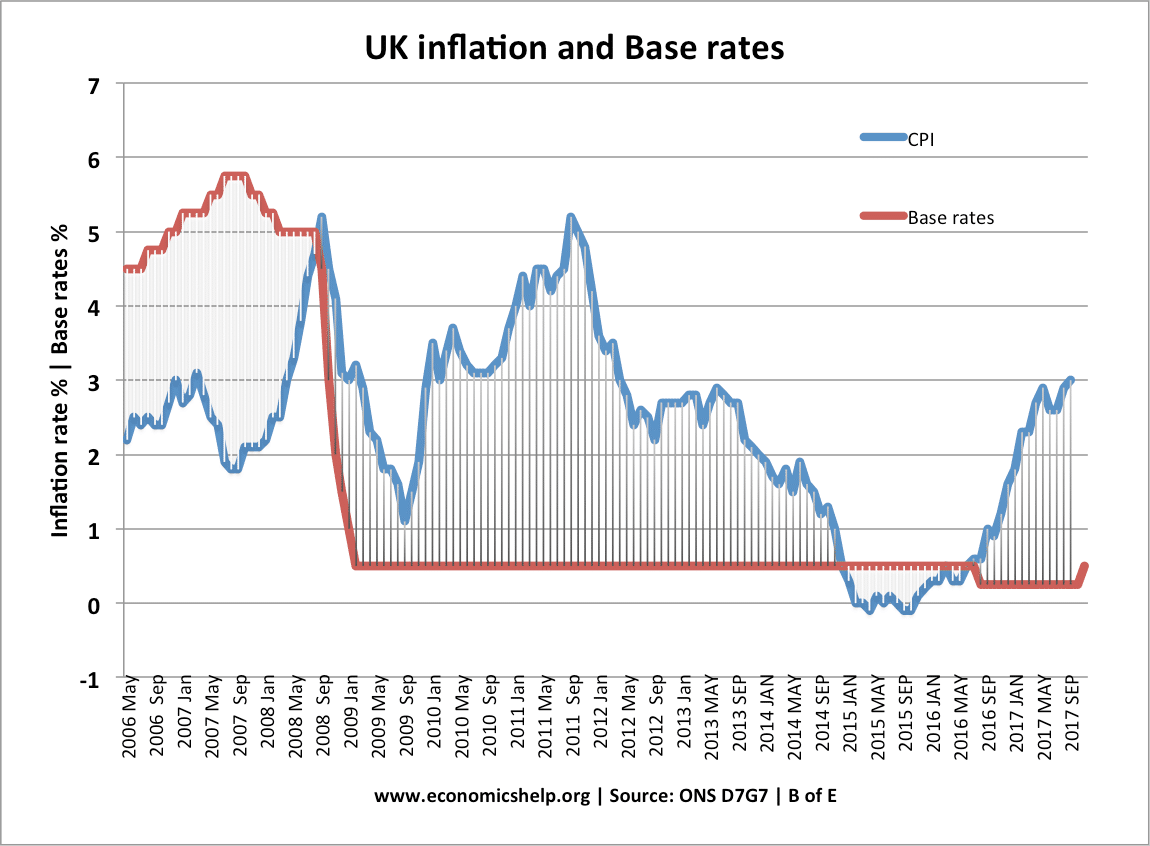

The Relationship between Interest Rates and Net Interest Margins

What follows will help you more fully answer the question: How does the Federal Reserve how banks make money if intererest rate rise rate affect me? When the Fed cuts rates, borrowing money tends to become less expensive since banks and lenders also typically lower rates on their credit products. Why the federal funds rate matters for consumers and the credit cards in your wallet has to do with minimum payments and interest charges. A Federal Reserve rate cut could translate to a lower minimum payment on credit cards and a lower cost to carry a balance from one month to the. For loans, a Fed rate cut could mean lower monthly payments and less interest paid out over the life of the loan. Lower borrowing costs can add money back to your budget that you could use to spend, save or apply to your financial goal of choice.

Comments

Post a Comment