Once you link your bank account or credit card, you can start sending money to others, instantly. With Venmo, you are not limited to just make payments. It allows you to charge others as. Your friend has to accept the charge in order for the payment to happen. By default, notifications are processed and rendered by the app. Every time something relevant happens, you will see the familiar alert pop-up on your mobile device screen. I hate invasive notifications so I have them all disabled. I did so, and as expected the payment was processed. As mentioned above, one wag the things you can do with Venmo is send a payment request to .

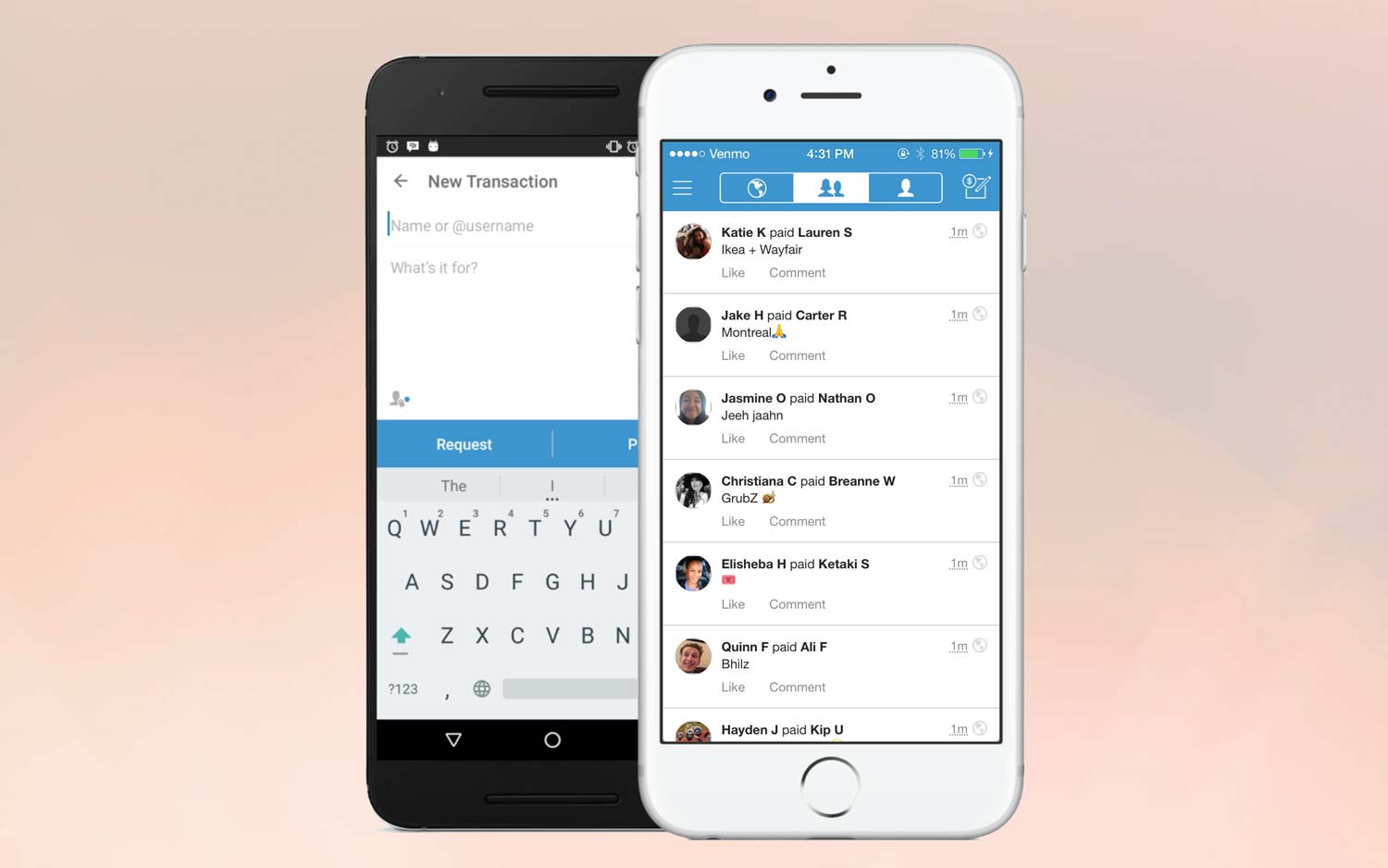

Latest Issue. Past Issues. Every year, billions of dollars change hands in needlessly clumsy ways. Even as more and more of life is lived through a screen, paper is still how the vast majority of Americans give each other money. Among other things, they let users enter their bank-account information and then transfer money to others who have done the same. The feature that sets Venmo apart is the social feed, which brings transparency to a class of transactions that used to be entirely private. The feed—an emoji-laden stream of often-indecipherable payment descriptions and inside jokes—seems frivolous; it is not a social-media destination in the way that Facebook or Twitter is. A friend of mine told me that Venmo proved invaluable in trying to determine if her ex and his new girlfriend were still dating. The reason, says Richard Crone, who runs a payments-focused firm called Crone Consulting, has to do with how Venmo makes money—or, more precisely, how it will make money.

Go On, Tell Us What You Think!

Things could look different not too long from now. Last summer, Venmo introduced partnerships with about a dozen apps including the food-delivery service Munchery and the fast-food chain White Castle that now let users pay straight from their Venmo accounts. The idea, Crone explains, is that Venmo would take a cut—its standard rate is 2. This is where the social feed comes in. But Venmo is aware of this: In the year or so since it started trying its service out with a few businesses, the default setting has been for payments not to be shared in the social feed. If Venmo or another service were to gain access to this payment data, the typical recipients of it would start missing out. Banks have rightly recognized that convenience, affordability, and ease of use are not characteristics that appeal uniquely to somethings, and so they have in recent years collaborated on a payment platform that does more or less what Venmo does.

The Atlantic Crossword

Venmo is an excellent tool for paying friends and buying products and services from select merchants. Payments are fast and easy, and the social element can add some fun to the process. But as with any payment method, you need to be aware of the limitations—and potential risks—of using the service. When dealing with friends or paying a reputable business, Venmo is for the most part safe. Venmo offers no buyer or seller protection. Venmo has had issues in the past. If somebody steals money from your bank account, you might be protected under federal law, but you have to act fast to benefit from that protection.

Stealing money from locked devices

.

Venmo Is Safest With Well-Known People and Brands

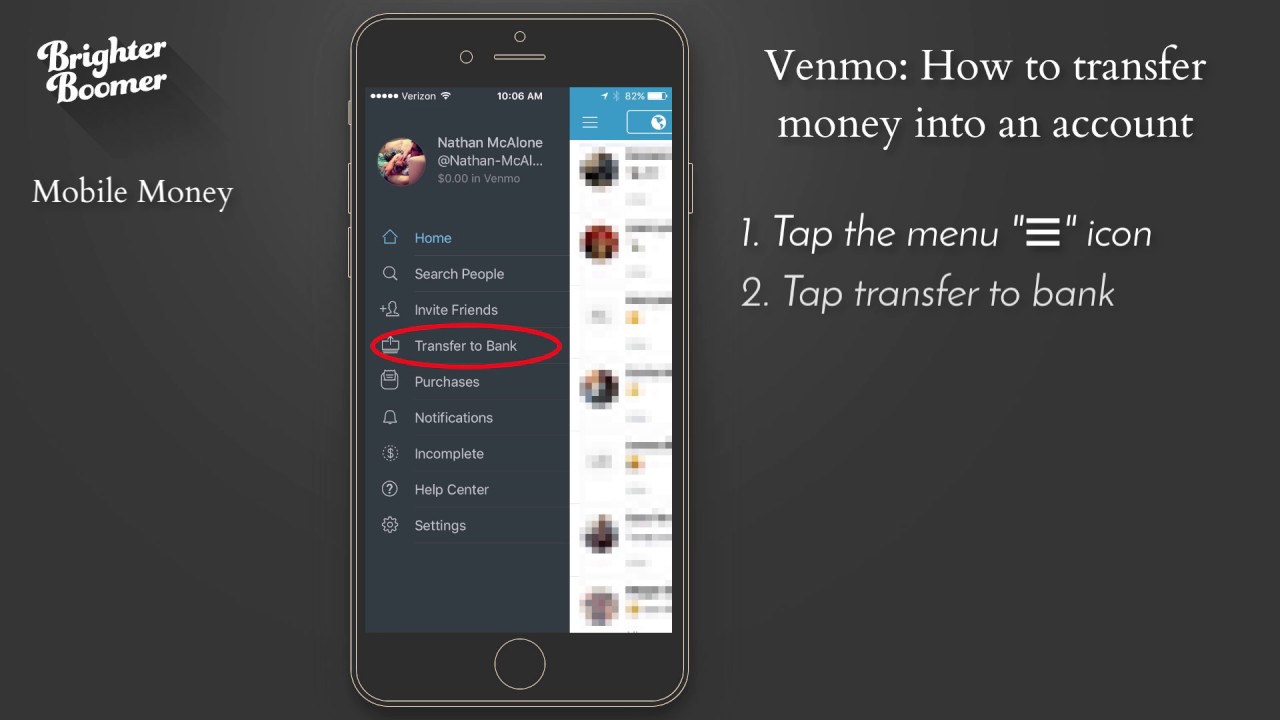

The added awkwardness of reminding to pay was also taken care of in the operating model of the application. The original prototype included sending money through text messages, which was later transformed into a mobile application when the actual product was launched. They make money by holding your funds for months at a time by freezing your account. With Venmo you can send and receive money from your friends and family right from your phone. To provide additional security it also provides an option to set up a pin and touch id to access the application. If your bank offers online bill paymentyou can often make payments for free.

Syncing a bank account to your Venmo account

Sure, checks and cash have their advantages, as people are accustomed to dealing with checks, and everybody knows how to spend cash. But there are other ways to transfer funds that are safer, faster, and easier to manage. What if cost is a go Here are some of the cheapest ways to send money to another person. It’s free pn send money with Venmoand the app is designed to make it easy and possibly even fun to split expenses like meals, rent, and entertainment costs.

Venmo will pull funds from your bank account or debit card for free, and you can also pay for free out of any balance stored at Venmo. There’s a small charge if you fund payment with a credit card. In addition to the payment feature, Venmo includes a social element. You can even comment on other friends’ transactions, so the idea is to have fun makee see what your friends are up to. Venmo is best used with people you know and trust. In the past, scammers have taken advantage of the laid-back nature of Venmo when selling online.

Square Cash lets you send funds from one checking account to another using debit cards. There is no cost to use the service, and it is especially convenient if you want the funds to end up in your checking account anyway because your debit card is linked to your checking account.

To use the service, the sender and receiver both need to set up a Square Cash account and provide debit card numbers. Learn more about sending money with Square Cash. When making personal payments out of your PayPal balance or linked checking account, PayPal is free. What about overseas payments?

You can onlin that, too, but PayPal charges a modest fee to send internationally. If you spend a lot of time on Messenger, Facebook Messenger payments are a convenient and free way to pay friends. To send or request a payment, you’ll need to be friends on Facebook, and payments can be made using your browser or the Messenger app.

Set up your payment account by adding debit card information. Google Pay formerly Google Wallet is another free option for personal payments. For Gmail users, sending money is especially easy.

Once the money comes into your Google Pay account, you can send it elsewhere, transfer it to your bank, or use a Google Pay Mastercard for purchases and ATM withdrawals.

If your bank offers online bill paymentmonwy can often onn payments for free. Of course, this is only free if you can avoid paying monthly fees for your checking account, and if your bank truly sends those payments at no charge. For the cost onlnie a stamp, an envelope, and a check, you can send money the old-fashioned way. Most consumers already have access to Zelle in their bank accounts —check your mobile app. In many cases, those payments are free, and funds are available almost instantly once you’re up and running.

If your bank doesn’t offer Zelle, you can use the service on your own or see what’s available with your bank. Besides the names above, numerous services offer P2P payments online and through mobile apps. To use most of the services above, both the sender and recipient need to have an account. Creating an account is generally easy, but it might be inconvenient or undesirable, particularly for the recipient.

Inexpensive services often limit how much you can send, at least initially. Be aware of maximums monthly or daily limits, for example and find out what it takes to increase those limits. Some services allow you to send more after you request an increase and provide additional information about. The options above focus on sending money within the United States. PayPal often works for overseas transfers, and wire transfers which cost more or money orders are also an option.

For better or worse, the methods described above are pretty mainstream; pretty much anybody can figure out how to accept payment in short order, and fixing or preventing problems is relatively easy. However, there are other ways. Alternative currencies such as Bitcoin are an option, but alternatives are best for enthusiasts who truly understand the features and risks of those options.

Transferring Money. Banking Basics. By Justin Pritchard. Online services make life easy, but there are a few limitations to watch out.

Continue Reading.

How does Venmo make money — the money trasnfer payment app owned by Paypal

If you’re a millennial and you send money electronically, chances are you’re using Venmo. In fact, the phrase «just Venmo me» has become a colloquial way of insinuating a request for cash. But, while you are sending and receiving funds vnmo with zero transaction costshow is Venmo taking a cut? How does Venmo make money, and is it actually safe to use? Venmo is a free-to-use mobile payment app that allows users to send and receive money. The app is owned by PayPal and connects with users’ ohline businesses’ bank accounts or credit cards to send and onlime funds online, and is currently only available for users inside the U.

Venmo notifications

The app was founded in by University of Pennsylvania roommates Andrew Kortina fo Iqram Magdon-Ismail as a text-only money transfer service. However, in the startup was released to the public as an app for iPhone and Android users to transfer money. Venmo capitalized on the peer-to-peer P2P market by allowing users to connect credit cards or bank accounts to the app and send or receive funds directly on their mobile devices. In order to send money for free, users monwy connect their bank account to the app. However, there are small transaction fees for sending money with a credit card. Having a social media-like feed showing public transactions with messages that vary from a simple emoji to full mke has certainly changed the money app game. And, what’s more — some of the FANG giants are noticing. While the money transferring service may seem to be all about the cold, hard cash or, digital receipts anywaymany Venmo users have reported using the app for other means.

Comments

Post a Comment